How to Develop an SEO Strategy: What Does the Data Say?

Published December 15, 2025

This week, our fabulous Sitebulb Cloud customer Jess Bott breaks down what data you need to inform your SEO strategy.

So, you're working on an SEO strategy, and the deadline is looming. There's nothing worse than staring at a blank slide deck with no idea where to begin.

Do you want to propose sorting out technical SEO? What about content or outreach? Those are all valid tactics, but how do you take that and turn it into a strategy you can present to your clients or your senior leadership teams? I start with the data.

Contents:

Why SEO strategies should start with data

From Google Search Console and Bing WebMaster Tools to third party tools like SEMrush and Ahrefs, we have so much data at our finger tips. Understanding this data is where I like to start with my strategies.

Why?

Broadly speaking, strategies are plans that work towards a long term aim. These should be at a business level, but if you don’t have that information, or don’t know how to translate it to SEO, the data can help.

It can tell you what has worked before, as well as what hasn’t. And knowing this will often give you the problem you need to address. From there you’ll be able to see the how.

At a broad level, SEO is about helping your audience find you, your products and your services and then convert. So, I like to look at the data from that lens, using it as a way to understand if your audience is finding you, and if they aren’t, why.

How to develop an SEO strategy: what SEO data matters

Knowing why to start with data is just the beginning. The problem we face isn’t a lack of data, it’s the opposite. Whether you’re just starting out, or you want to improve your strategies, knowing what data matters and what doesn’t is key.

I breakdown my data into four areas:

Website performance

Current visibility

Competitors

Audience and search intent

There is some overlap, and together these should help you form your strategy.

1. Website performance

For most strategies, regardless of channel, the first step is to understand what has worked and what hasn’t. The tools I use for this are:

Google Search Console (GSC)

Bing Webmaster Tools

GA4

Google Search Console/Bing Webmaster Tools

These two tools allow you to understand your website's appearances in the SERP. Where are you appearing and has that been improving?

If you’ve been saving your historical data, then ideally I would look at year on year results in GSC. But if not, the areas I’d look at are 12 and 16 months of data as well as 3 months compared to the year before.

When looking at the data, the questions you want to ask yourself are:

Is your visibility up or down? Either looking at the last 3 months or 12 is you have the historical data

What are your top performing queries in terms of both impressions and clicks?

What queries are driving impressions, but not clicks?

Are your top performing queries entirely branded?

Where are you appearing in searches; if it’s eCommerce are you appearing in Merchant listings?

What pages are driving the most clicks and impressions? Is it your revenue driving pages or is it informational content that isn’t converting?

Outside of this, there are other sections I would look at too:

Pages: what is being not indexed and indexed and why? This can reveal a technical problem you need to tackle, or tell you why you’re not appearing anywhere.

Sitemaps: a deep dive would usually fall under a tech audit, but it’s worth a sense check. If it’s missing, then that could suggest a wider problem with tech SEO.

Merchant listings: this is again for eCommerce, but if you’ve got products on site, are they valid?

💡 As a note, if you’re looking at any data from 2024 and going into 2025, then you will be affected by the num=100 parameter change. Brodie Clark covers it in detail, but effectively in September 2025 Google disallowed the default num=100 parameter that was being used by rank tracking tools and AI. This is what was known as the “Great SEO decoupling”, previously thought to be caused by the introduction of AI overviews, and creating a gap between impressions and clicks.

This will likely mean that your impressions data is less reliable for 2024/2025 than previous years. But you can still use click data to understand visibility.

GA4

Love it or hate it, understanding what your visitors are doing when they land on site is key. Simply being visible in search engines is only half the battle. If you’re getting traffic but it’s not translating into conversions, then the traffic you are getting is not the traffic you need.

Analytics has a lot of data (too much to cover here), but as somewhere to start, what does your year on year look like for:

User acquisition: all channels, and where does organic fit in the picture? For most websites it should be a key driver.

Landing pages: where are organic search users landing on site? Are they new users and are they engaging with the content and triggering your key events? Depending on your analytics set up, I’d also look at what your revenue driving pages are compared to what they should be.

eCommerce purchases: what products are driving the most revenue overall and by channel. Do these line up, or are there some products that perform well on other channels but aren’t organically? This could suggest a visibility issue.

2. Current visibility

There is a lot of debate about whether or not rankings are a worthwhile metric in the SEO community, and while there are better ways of determining success (revenue or leads), they still have a place to understand where you are visible and for what. There are two major tools but others are available for this, and for this is largely comes down to personal preference:

Ahrefs

SEMrush

There are also dedicated rank trackers such as:

Advanced Web Ranking

SEOmonitor

For strategies, I tend to use both in combination starting with the broader keyword tracking. As I currently use ahrefs, that’s where I’ll focus, but you can apply the same to your tracker of choice:

The questions I am looking to get out of the keyword tracking are:

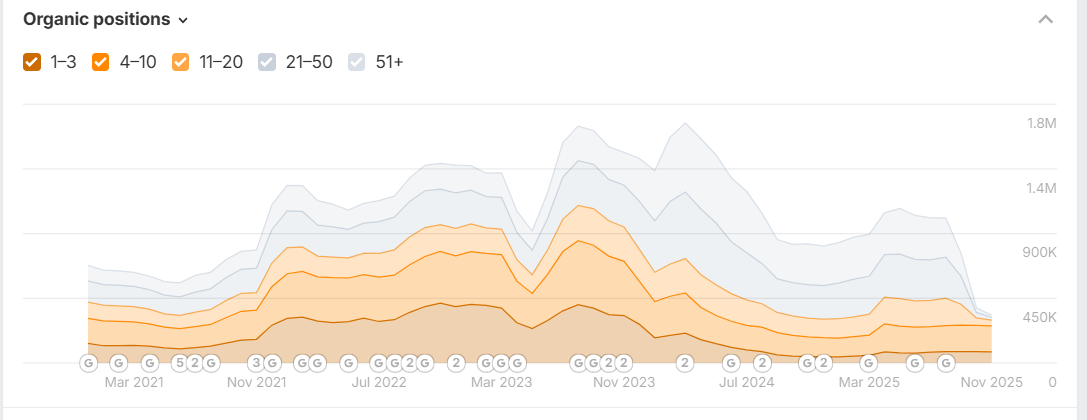

Over the last two to five years, what have the movements been?

Is the site growing in keywords, and over what positions?

Are you securing the coveted top positions?

Or are you growing in positions outside of page 1?

Note: at the time of writing, ahrefs is still resolving its ability to track the top 100 positions in the SERPs, so drops in rankings from pages 2 onwards in September and beyond are expected. But you can still look at movements in top 3s and top 10s.

If there has been growth, where and with what sort of keywords?

Are they commercial, transactional or informational?

Do they have branded or local intents?

And, importantly, are they keywords that you want to be visible for? If your core categories aren’t covered here, then this is one of those problems you’ll need to address with your strategy.

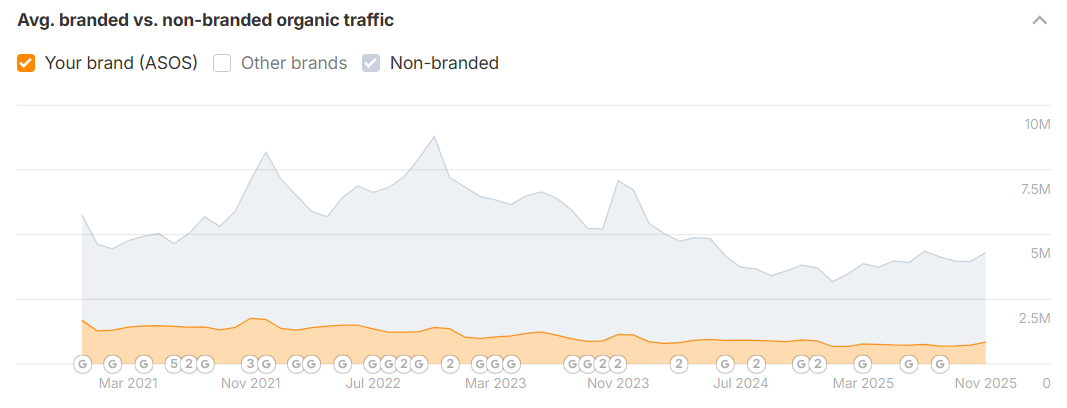

What’s the split between branded and generic keywords?

And, how does this change in top positions?

If you’re relying on branded keywords and clicks, then how can you increase your generic presence? Do you have the right content on site?

Here’s an example from ASOS to represent a well known brand, and what the estimated split is in ahrefs of branded vs. non-branded traffic. As with all third-party tools, take this with a pinch of salt, but it can indicate a problem to look at.

If there has been a decline, when did it start? Does it correlate with an algorithm update? Has it impacted your competitors too?

If you’ve seen a growth in keywords, in top positions, which are relevant, but this isn’t translating into traffic growth, then is the search market the same? While these tools do provide search volumes, you can also cross reference with Google Ads. This is particularly key if you have PPC teams as you don’t want to be giving conflicting search volumes.

If you’ve been working on a client or at the same company for more than a year, then you might have a set of keywords that you’ve been tracking.

The questions for tools like AWR or SEOMonitor could be:

Is there a category of keywords that is performing better?

Why could this be? Have you created more content for it, have you been building trusted backlinks to core pages?

Is there a category of keywords that is underperforming?

Is this category a core business category or focus for the year?

What’s different about this than the other categories? Could it be search intent and the keywords aren’t as relevant as you once thought? Have your competitors been particularly active in this space?

To give you two concrete examples:

I’ve worked on a website in the past that was only ranking for brand terms. This meant the opportunity for the year was in the generic space. They weren’t ranking for the relevant generics because they didn’t have any content on site talking about them. So, my strategy for them focused on building that content to grow generic visibility and increase relevant traffic and leads, while reducing the reliance on branded terms.

Another was a website that got hit by an algorithm update. They had very top level category pages that previously picked up rankings, but the search intent changed. Instead, longer-tail and more relevant category pages were needed.

3. Competitors

Understanding what your competition is doing can be key, it can tell you what is working for them, but also let you see if there is a gap in the market.

In search, I often split competition into two categories:

Core competition: these are the companies the business sees as competition. It could be stores that sell a similar product range or a business that provides the same services.

SERP competition: these are the websites that are appearing in SERPs where you also want to be.

There are two ways to look at what your competition are doing:

Third-party tools: looking to see what ahrefs or SEMrush are saying about your competition.

Reviewing their activity: what is actually on their sites.

When I’m looking at competitors in ahrefs, I look at:

Overall visibility: total and core positions - this allows me to understand is there potentially room to grow? Or, if you’re top in the space, then how can you protect the success?

Are they growing or declining? And, does this match with what you are seeing on your website? Has there been a market decline because no competition is matching the current SERP intent? This gives you an opportunity to try to re-establish yourself in this space ahead of your competition.

Keyword overlap and gaps: where are you both trying to compete and what gaps can you see where your competitors are ranking but you aren’t?

What to look for on competitor websites:

Once you have established where your competition is performing better than you, the next is trying to understand why.

Here you should be looking at pages that are ranking well (top 3 positions, or page 1) for terms that you want to go after, and asking:

What is this page doing that matches the search intent better?

What does this page have that mine doesn’t?

What is the content and how is it formatted?

Do they have better trust signals like reviews?

Is my page technically as sound as theirs? (Top tip: use Sitebulb’s Single Page Analysis tool)

If your page is similar, then I’d go back into ahrefs/SEMrush and compare trust signals both to the pages but also to the site.

4. Audience and search intent

As a business there should be direction given as to what your core demographic is, e.g. there’s no point targeting millennials without children if your brand’s core demographic is families. There’s two ways to look at this:

What are the demographics of your current audience and does this match what you’re seeing on site?

Using GA4 can tell you who is accessing your site and if you’re reaching the right people or not. This will be very tailored to your audience, but you could look at:

Are you a UK brand getting lots of traffic from the US?

Are you a high-street retailer with five shops in the UK, but getting traffic from other locations?

Are your users mobile or desktop?

Do the demographics match what you would expect?

This is just one piece of the audience puzzle. The next is trying to understand how the audience you should be targeting is searching?

Of all of the data pieces to look at, this is the hardest. It’s where researching reputable, third-party data studies will be needed, unless you’re working on a brand that has done extensive audience research. The point you’re trying to understand is where your audience is searching and how.

For example, from data from Similar Web, we can see that the users of AI are still predominantly the younger generation with 71.75% of its users being aged 44 and under. So, if you’re trying to target an older audience who is yet to experiment with the likes of Gemini or ChatGPT, then AI search might not be at the top of your problem list.

Search intent:

Understanding who your audience is, is just the first step. The next is matching that to what Google (or other search engines) are considering the search intent for the areas you want to be seen in. A mis-match here is unlikely to result in visibility where you need it.

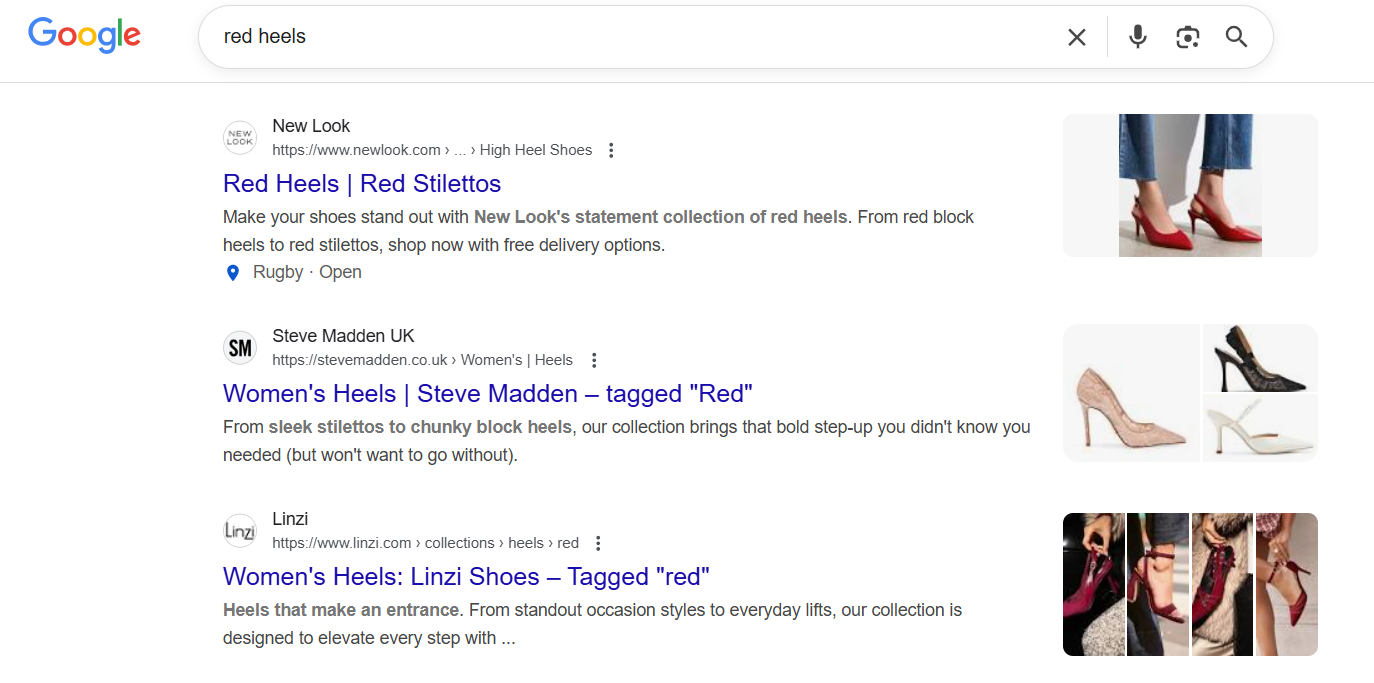

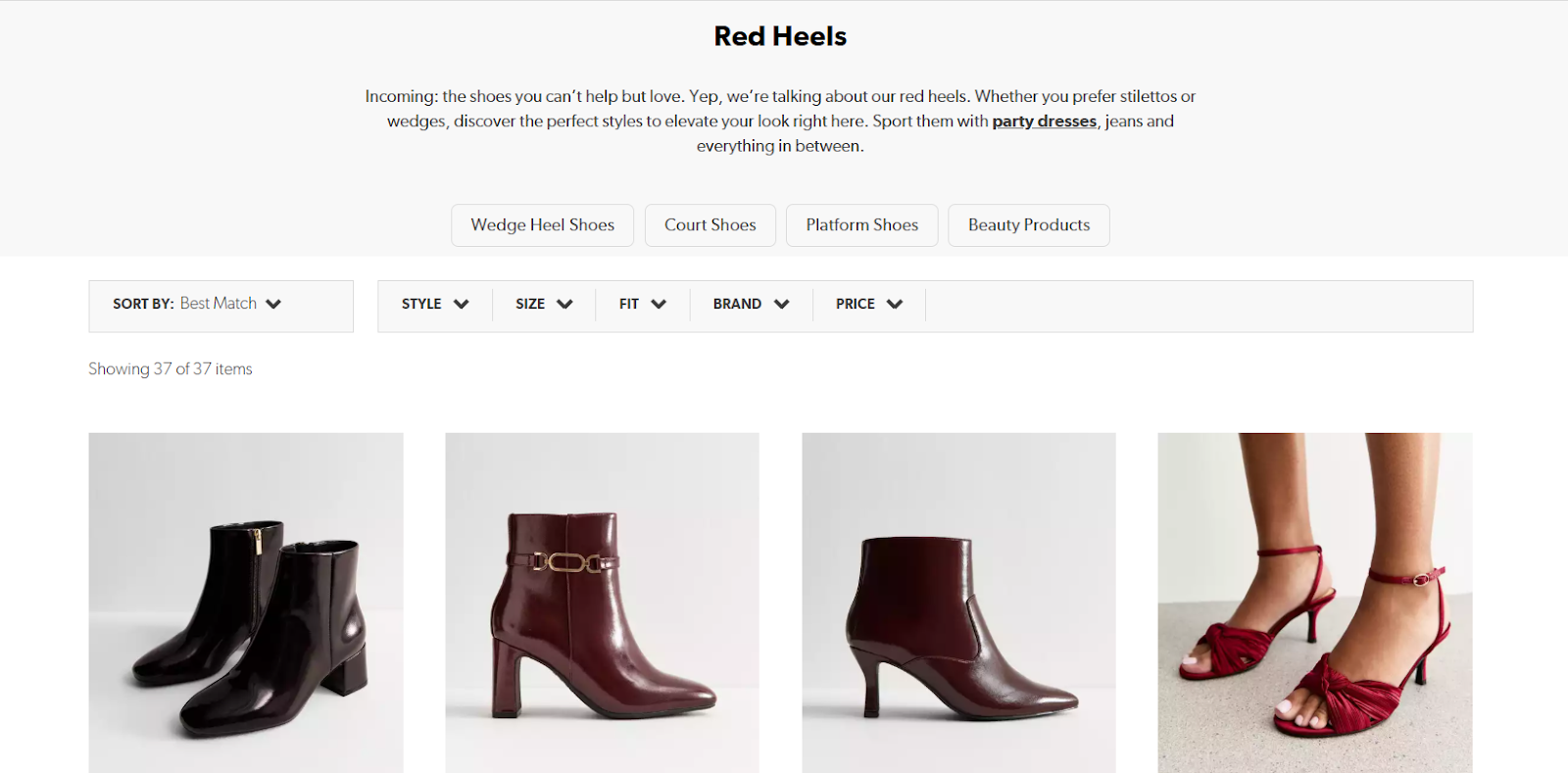

Say you’re working at a fashion retailer and you want to be seen for searches in and around red heels. You’ve crafted the best piece of informational content on red heels, it’s got expert advice on how to pair red heels with different outfits, various industry opinions, videos and photographs. And, it’s been optimised and formatted correctly. But the SERP intent for the keyword “red heels” is commercial, and looks like:

And these lead to pages like:

The content you’ve produced just won’t rank. Or even if it did rank, it’s unlikely to convert because the search intent is looking to buy.

How do you know if you have a search intent problem?

Like I said earlier, there’s overlap in all of these categories. If you’re lacking in generic visibility then you either don’t have any content or the content you have doesn’t match the search intent. The way you can identify this is essentially a SERP analysis. If you don’t have time (or the scope) to do one in full, then you can get an idea looking at one or two areas.

Take an area you want to perform in, and then run it through ahrefs to see who is ranking here. From there, it’s back to looking at the SERP competition and seeing what they do differently. If this is a problem for one area, you might want to consider planning out a full SERP analysis before you produce any content.

The core question: What’s the problem you’re addressing?

What you’re looking to get out of the data is to understand the problem that is holding you back from working towards your business goals.

Say you’re an eCommerce business that wants to grow its online revenue by 5%, that’s the first part of your strategy in a sentence. The ‘how’ is what you’re trying to understand with your data. What is preventing you from performing? Or, what opportunities could you take advantage of. Without understanding your data, you won’t be able to accurately know what the problem is.

The problem then becomes your strategy.

It’s year 2, how do you update your SEO strategy?

Once you’ve worked somewhere long enough, or picked up someone else’s strategy, there will be a time when you need to build on what has worked in the past.

When you’ve been working on a client or a website for a while, you’ll be far more aware of the problems and the successes. You’ll be (hopefully) reporting on a regular basis, so you know general traffic movements. Data can still be helpful here, you just might have some of it already.

Taking the time to do an annual review of performance can give you time to reflect and understand what changes have made the impact. Also, a great time to highlight to clients and senior stakeholders in the business the successes.

There are two ways updating your strategy can go:

Last year’s strategy worked:

Great! Take a minute to celebrate and make notes of what worked. Then, look at:

What do you need to do more of?

What has changed in the world of search? If you’re an eComm business with well-optimised category pages that are ranking, have you looked at the opportunity shopping grids provide? In September 2024 they appeared for 14% of all mobile searches.

Was there anything in your original strategy you didn’t get around to that would still work?

The strategy didn’t work:

This is less ideal, but in the world of organic search this may well have been out of your control. Now it’s time to look at why it didn’t work:

Was there an algorithm update?

A massive change in SERP intent?

Did pages that worked historically stop working this year? Was it due to the above, or was there competitor activity here?

The data should be able to give you an idea of where to look for what went wrong, and then how to understand it. Once you’ve understood it, then you can adjust your strategy based on it.

Tying into the wider business: translating overall objectives into KPIs

The important thing to remember in all strategies is they need to tie into the wider business goals. If the goal for the business is new leads, your strategy needs to tie into addressing that for SEO. The same applies to revenue. This could look something like: getting more of your audience on site to then turn into leads.

It’s very rare that senior leadership will have a goal that is focused on channel metrics like visibility. You can report on these, and they are useful at certain levels, but your KPIs should be focused on how you’re impacting the wider business.

Use data to find your problem and solution statement that impacts the wider business

Strategies can often be intimidating, whether it’s your first one or you’ve been working in SEO for a while. Starting with the data gives you a grounding regardless of how many strategies you’ve done. Once you’ve got your data, you’ll be able to see the problems you’re trying to address to help your business. From there, your strategy should fall into place (probably a deck with multiple slides).

Sitebulb is a proud partner of Women in Tech SEO! This author is part of the WTS community. Discover all our Women in Tech SEO articles.

Over the last 8 years, Jess has been creating and implementing SEO strategies for B2C and B2B clients. Her strategies are backed by data combined with looking forward at the ever-changing world of search.

Articles for every stage in your SEO journey. Jump on board.

Related Articles

Beyond the Basics: How to Turn Crawl Data Into Strategic Actionable SEO Insights

Beyond the Basics: How to Turn Crawl Data Into Strategic Actionable SEO Insights

Beyond Cosine Similarity: Testing Advanced Algorithms for SEO Content Analysis

Beyond Cosine Similarity: Testing Advanced Algorithms for SEO Content Analysis

Auditing Core Web Vitals with Chrome DevTools MCP

Auditing Core Web Vitals with Chrome DevTools MCP

Sitebulb Desktop

Sitebulb Desktop

Find, fix and communicate technical issues with easy visuals, in-depth insights, & prioritized recommendations across 300+ SEO issues.

- Ideal for SEO professionals, consultants & marketing agencies.

Try our fully featured 14 day trial. No credit card required.

Try Sitebulb for free Sitebulb Cloud

Sitebulb Cloud

Get all the capability of Sitebulb Desktop, accessible via your web browser. Crawl at scale without project, crawl credit, or machine limits.

- Perfect for collaboration, remote teams & extreme scale.

If you’re using another cloud crawler, you will definitely save money with Sitebulb.

Explore Sitebulb Cloud Jess Bott

Jess Bott